-

Consistency Is Not Boring

- by: Hank Berkowitz

- July 14, 2022

No CommentsOn more than one occasion, my wife has accused me of being the most boring man in America. I eat the same thing for breakfast and lunch every day. I drink the same brand of beer every night. I wear the same five outfits to work (one for each day of the week). I’ve worn

-

From Markets to Memorial Day Let’s Keep Things in Perspective

- by: Hank Berkowitz

- May 30, 2022

When thoughts turn to beaches, beer, barbecues and baseball over the three-day Holiday weekend, it’s easy to lose sight of what Memorial Day is all about. We’ve retail-ized the last weekend in May into the official “kickoff to summer” celebration. In reality, we’re supposed to be honoring U.S. military personnel who have died serving in

-

Financial Literacy Month Should Last 365 Days

- by: Hank Berkowitz

- May 13, 2022

April and National Financial Literacy Month are in the rearview mirror. But that doesn’t we should take our feet off the gas pedal when it comes to addressing the nation’s financial literacy epidemic. According to our annual CPA/Wealth Advisor Confidence Survey, just one-third of financial advisors (38%) believe America’s financial awareness has improved in the

-

Grit

- by: Hank Berkowitz

- April 3, 2022

These are not the easiest of times. So many anchors of security in our lives seem to be disrupted. At times like these people tend to react in one of two ways: (1) throw the covers over your head, or (2) dig in, do the hard work and show a little grit. With the highest

-

March Madness Confirms Humans Don’t Add Much Alpha

- by: Hank Berkowitz

- March 23, 2022

First let me tell you why I love the annual NCAA men’s Division I basketball tournament (aka March Madness). It’s the ultimate reality show. Where else can little known universities such as St. Peters, Loyola of Chicago, Murray State, Weber State, Florida Gulf Coast and Valparaiso suddenly jump into the national limelight with upset wins

-

Baseball: The National Past (It’s) Time

- by: Hank Berkowitz

- March 4, 2022

With all the problems in the world today, the last thing we need are billionaire team owners squabbling with millionaire ballplayers over money. With Opening Day and the first week of the Major League Baseball season canceled, fans and viewers may not return if and when the owner-player dispute is settled. With a “minimum wage”

-

Inflation Worries Inflated?

- by: Hank Berkowitz

- February 23, 2022

Yep, we have plenty to worry about as we grind through another seemingly endless winter on the two-year anniversary of the pandemic (2/22/22). Russia has invaded Ukraine. The first of many interest rate hikes seems imminent. Tax rates are likely going up. COVID remains omnipresent. The long-running bull market is taking a breather to massage

-

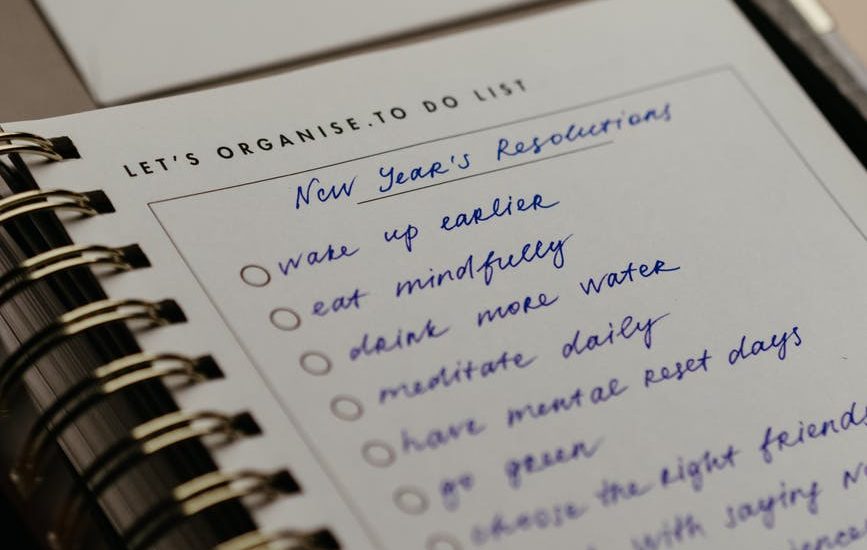

Last Chance to Get Your New Year’s Resolutions Right

- by: Hank Berkowitz

- December 15, 2021

Two thirds of advisors (68%) who responded to our weekly Insta-poll believe this Holiday season has been more stressful than usual from both a business and personal perspective. So, after another difficult and stressful year, don’t beat yourself up for overeating, overspending, over-pouring and oversleeping a little during the Holiday season. Same goes for your

-

Helping Clients with Chronically Ill Children

- by: Hank Berkowitz

- November 26, 2021

“Caring for a child with an illness is taxing on your physical and mental health. Take time to appreciate the positive moments when the light peaks through, while also building a community around you early and consistently to guide you through the difficult times.”

-

Are We in a Bubble?

- by: Hank Berkowitz

- October 28, 2021

Last week’s post about the record high “Quit Rate” of American workers generated a fair amount of feedback. Some said “it’s about time” that workers finally gained some leverage over greedy employers, but the majority questioned the wisdom of workers flexing their bargaining muscles at this stage of the economic cycle. They said it was