By Blaise Mazurkiewicz, guest columnist

According to our firm’s annual CPA/Wealth Advisor Confidence Survey three out of five (63%) respondents believed that financial literacy and awareness has not improved over the past two years. Even more troubling, the data found financial advisors were more pessimistic about the younger generation’s financial future than any other generation.

Why?

As a member of Gen Z, I’m not sure I agree entirely with that assessment. I do agree with the survey findings that our educational system is not doing nearly enough to prepare young people to be financially responsible adults. For instance, the State Department of Education does not require personal finance to be taught in schools unless there is a bill created by a state legislature and passed by the state’s voters.

Case in point: The high school I attended offers a basic one-semester class on financial literacy. I heard the class was okay, but not great. Since the class wasn’t required and I had a heavy academic load and sports commitments every semester, I didn’t take it. In fact, our firm’s report pointed out that less than half of U.S. states require their K-12 students to take a class in personal finance.

Does lack of financial literacy stem from school system neglect?

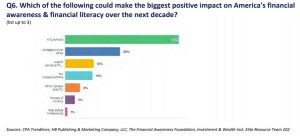

Absolutely. It’s an issue that needs to be addressed, not only by elementary and secondary schools, but also by colleges and universities. As our firm’s data showed, nearly seven in eight (86%) financial advisors believe that K-12 school, colleges, and universities could collectively make a bigger positive impact on America’s financial awareness and literacy than any other institution in our society – by far. But don’t just take it from me.

“Our school systems haven’t done enough,” agreed Bismaad Gulati, a Fordham University Gabelli School of Business student. “Most of my friends have gone through the same classes I have but aren’t as interested in finance or business as I am.” Gulati told me recently. “I think they’re not as well equipped, which is an obvious issue.”

Although bills have been passed to improve the gap in financial literacy education, it seems like lawmakers haven’t reached a large enough audience to make a significant change so far. As stated in our firm’s report, financial advisors overwhelmingly felt K-12 schools – more than any other institution in our society – could make the biggest impact on America’s financial literacy. Nearly three in five respondents (58%) agreed.

This needs to change.

Owen Brennan, marketing major at the University of Connecticut School of Business recently told me that personal finance classes should NOT be optional and that there should be more of them. “We shouldn’t be expected to fall back on material from our math courses in order to understand what’s going on. At a younger age, and especially in high school, we need somebody to help connect those dots for us,” Added Brennan.

From where I sit, the more dots that younger generations can connect, the better we can see the whole financial picture. Whether it’s student loans, personal investments, or just managing our money. It’s not just about doing the math, but understanding what the clear drivers of our financial well-being are.

What will the future landscape of financial literacy look like, especially for Gen Z and other younger members of society? Gulati said he hopes to see more required personal finance courses in schools, in addition to people taking better advantage of resources available to them. “The internet is a big place and our generation loves to use it,” said Gulati. “I just hope we can collectively figure out how to use it for more than just entertainment and leisure purposes though. If not, that’s sort of on you. Everyone is the master of their own destiny,” he added.

It’s hard to argue with Gulati here. Our generation has more access to (and willingness to use) information than any other generation in history. The way that we can quickly access information explains why overall literacy is higher than before. That being said, hopefully this will translate into higher financial literacy in the near future.

As Brennan said: “ The bright spot comes from our resources. We have access to great tools like YouTube, online courses, and social media influencers that can all help to generate higher levels of literacy,” added Brennan. With these tools in the hands of Gen-Z and other aging generations, the future offers a myriad of opportunities to improve our financial literacy.

How confident are you that the world’s younger generations can improve their financial literacy and overcome the disconnect between financial literacy and education?

Tell me what you think.

Blaise Mazurkiewicz is a marketing associate at HB Publishing & Marketing Company, LLC in Norwalk, CT

# Financialliteracy, #GenZ, #Education, #Finance